Yesterday, the China Insurance Regulatory Commission issued the "Notice on Doing a Good Job of Protecting the Rights and Interests of Consumer Insurance Consumers." It put forward five solutions to the problem of insurance claims that are commonly reflected in the society. Yesterday afternoon, Chairman of the China Insurance Regulatory Commission Xiang Junbo issued an ultimatum on the automobile insurance claims at the chairman’s office meeting, requiring that it take three years to resolve claims.

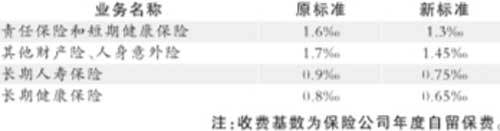

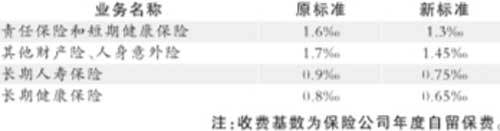

New and old insurance business supervision fees

"Notice" proposes five solutions to the problem of difficult insurance claims: First, it requires property insurance companies to shorten the working time limit of each link, simplify claims procedures, establish and improve the mechanism for quick compensation and quick disposal of small amount of pure property damage auto insurance, and second, modify and improve auto insurance clauses. , To determine and determine the rights and obligations, especially in the practice of claims, disputes easily arise vehicle repair vendors, spare parts sources, parts repairs and other issues, in the contract should be clear; third is to regularly carry out car insurance backlog bills liquidation work The fourth is to strengthen the training of auto insurance workers, improve the sense of responsibility, business ability and service quality.

In addition, the "Notice" also requires insurance regulatory agencies to improve the supervision and evaluation standards for auto insurance claims services, and make regular announcements to the public, and require that a unified insurance consumer complaints phone number be established nationwide as soon as possible.

Xiang Junbo pointed out that through comprehensive management in 3 years or so, the property insurance company’s awareness of auto insurance claims management services should be significantly enhanced, and the claims management and service system should be further improved; the industry standard, a unified auto insurance claims service system, service procedures and service standards. Initially formed; based on informatization and transparency, the evaluation mechanism, open mechanism, and supervision mechanism for auto insurance claims service were preliminarily established; the institutional mechanism for strengthening the supervision of auto insurance claims service quality was constantly improved; and the insurance consumers’ complaints about auto insurance claim service were significantly reduced. The public’s recognition and satisfaction with auto insurance services have increased significantly.

New and old insurance business supervision fees

"Notice" proposes five solutions to the problem of difficult insurance claims: First, it requires property insurance companies to shorten the working time limit of each link, simplify claims procedures, establish and improve the mechanism for quick compensation and quick disposal of small amount of pure property damage auto insurance, and second, modify and improve auto insurance clauses. , To determine and determine the rights and obligations, especially in the practice of claims, disputes easily arise vehicle repair vendors, spare parts sources, parts repairs and other issues, in the contract should be clear; third is to regularly carry out car insurance backlog bills liquidation work The fourth is to strengthen the training of auto insurance workers, improve the sense of responsibility, business ability and service quality.

In addition, the "Notice" also requires insurance regulatory agencies to improve the supervision and evaluation standards for auto insurance claims services, and make regular announcements to the public, and require that a unified insurance consumer complaints phone number be established nationwide as soon as possible.

Xiang Junbo pointed out that through comprehensive management in 3 years or so, the property insurance company’s awareness of auto insurance claims management services should be significantly enhanced, and the claims management and service system should be further improved; the industry standard, a unified auto insurance claims service system, service procedures and service standards. Initially formed; based on informatization and transparency, the evaluation mechanism, open mechanism, and supervision mechanism for auto insurance claims service were preliminarily established; the institutional mechanism for strengthening the supervision of auto insurance claims service quality was constantly improved; and the insurance consumers’ complaints about auto insurance claim service were significantly reduced. The public’s recognition and satisfaction with auto insurance services have increased significantly.

Engine Cooling System,High Quality Engine Cooling System,Engine Cooling System Details, CN

Suzhou Arenland Automotive Technology co.,ltd , https://www.arlautoparts.com